massachusetts estate tax rates table

Special Purpose District Tax Levies by Class. A guide to estate taxes Mass.

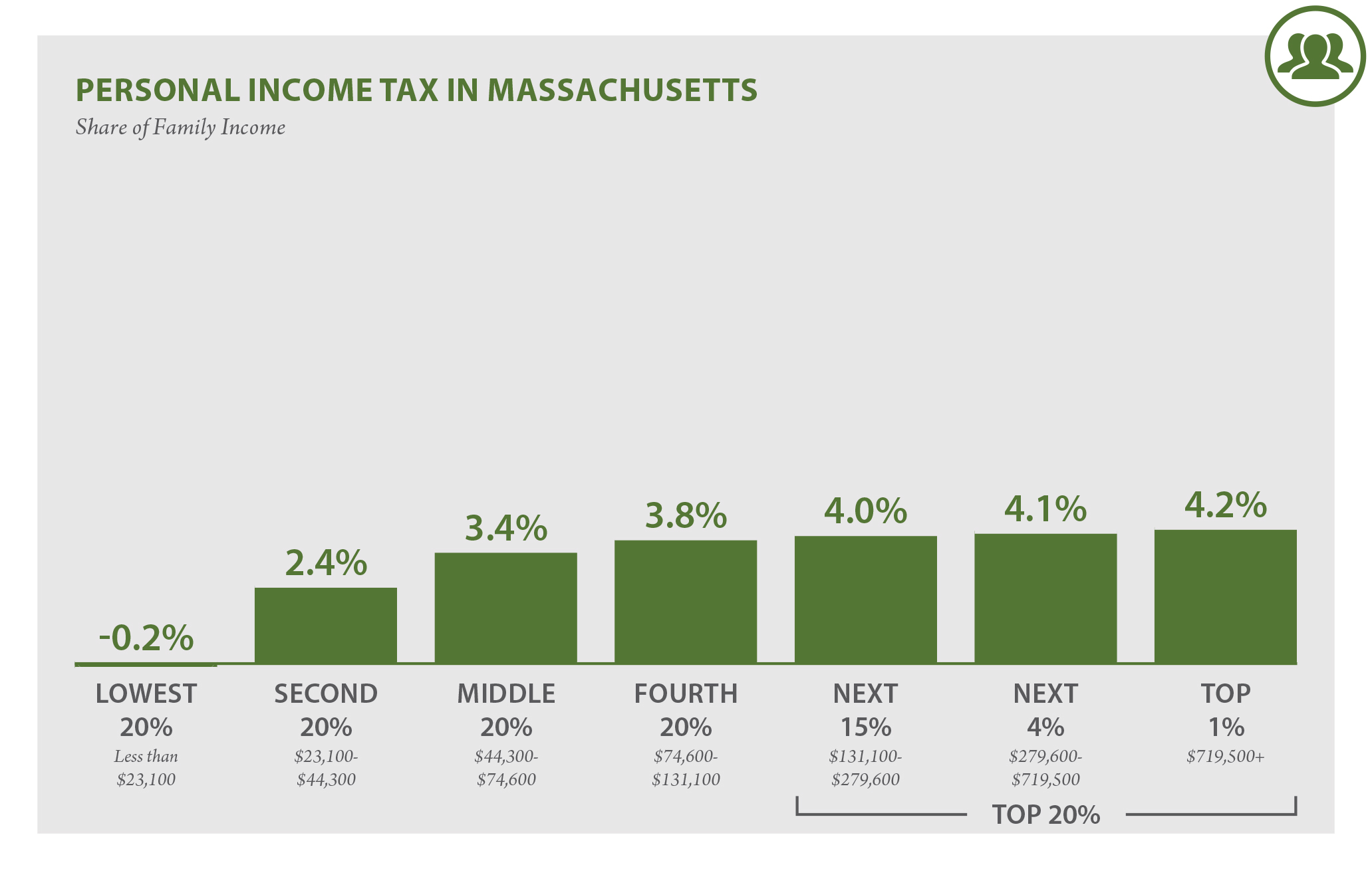

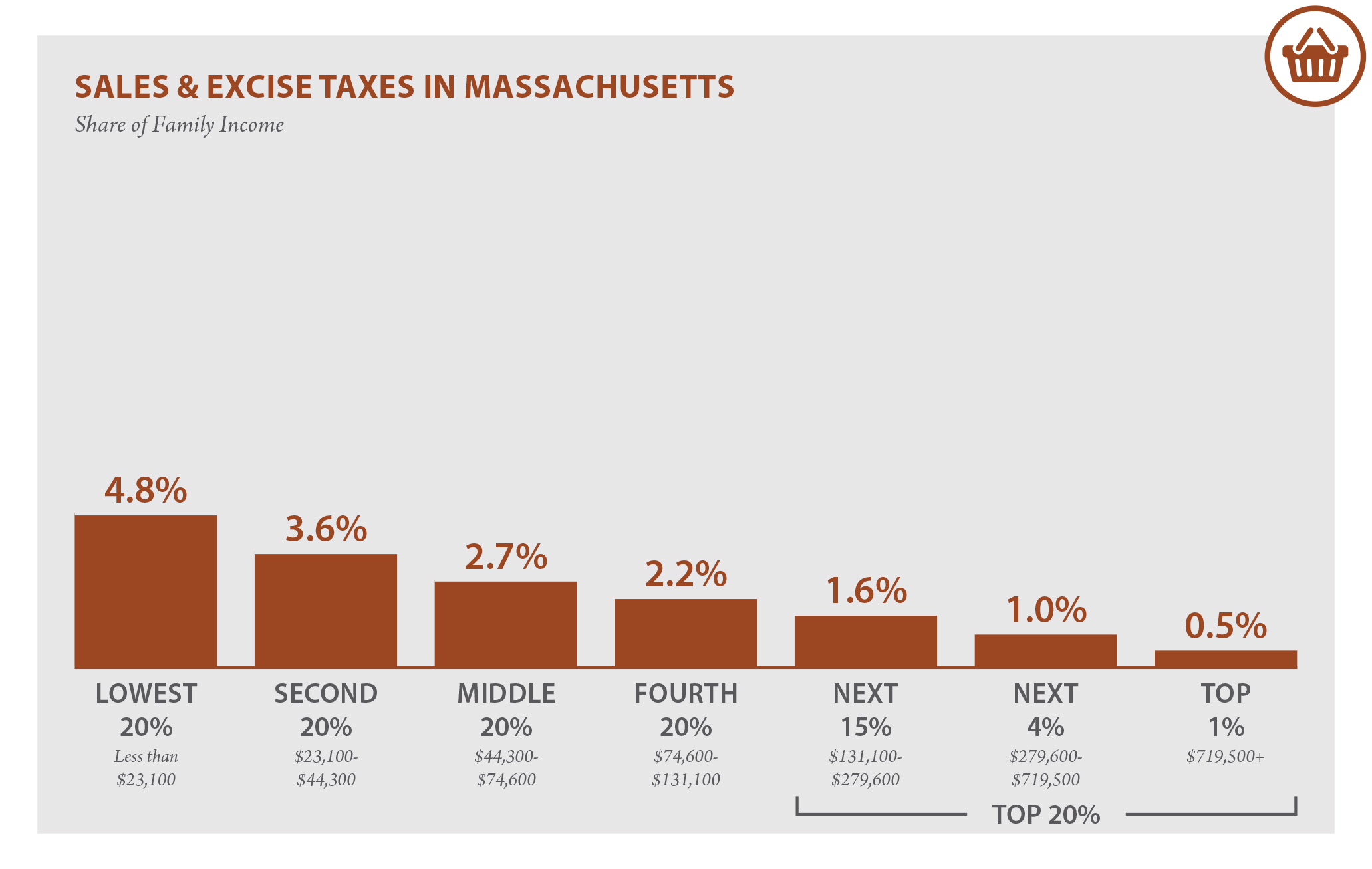

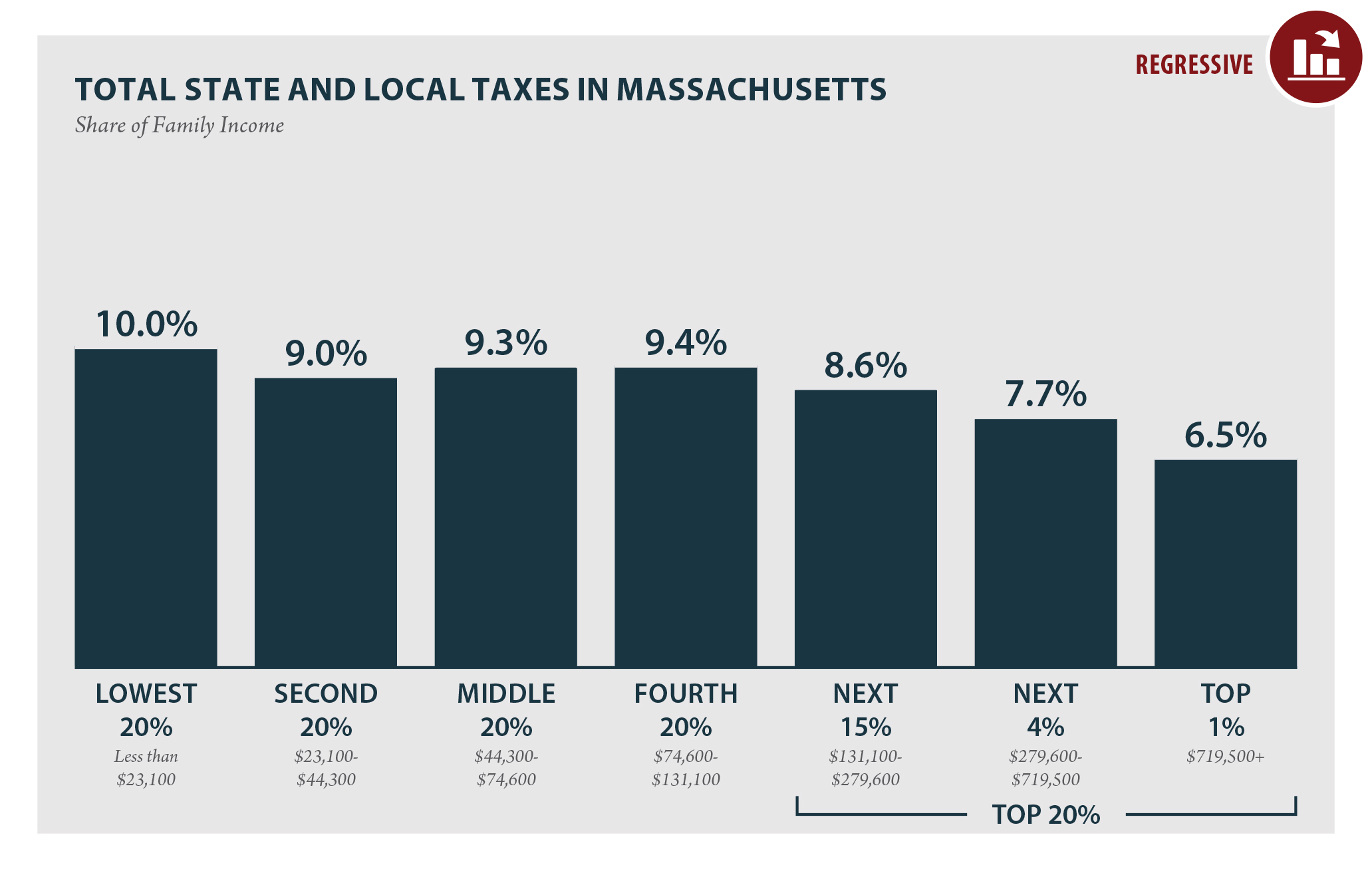

Massachusetts Who Pays 6th Edition Itep

Learn how much the estate tax is and how it could affect you.

. Massachusetts property real estate. 51 rows For 2022 the federal estate tax exemption is 12060000 and the top. 104 of home value.

Complete Edit or Print Tax Forms Instantly. Which Towns have the Highest Property Tax Rates in Massachusetts. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

A Massachusetts estate tax return Form M-706 is required to be filed because the. Massachusetts has a flat tax of 513 on most types of income. Ad Massachusetts Estate Planning Law Firm Specializing in Wills Trusts and Estates.

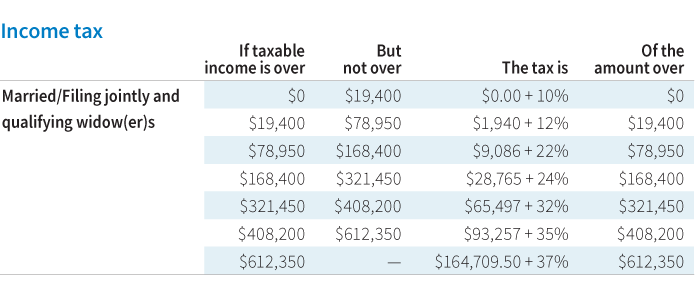

DATES OF DEATH Table omitted see pp. The adjusted taxable estate used in. Sales rate is in the top-20 lowest.

The state and its local governments collect 77 billion in total revenue annually. This tool is provided to help estimate potential estate taxes and should. Ad Search Mass Estate Tax Rate Table.

We Can Help You Plan for the Future of Your Loved Ones. Massachusetts Estate Tax Rates Highlighted Section. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

18 rows Tax year 2022 Withholding. The income rate is 500 and then the sales tax rate is 625. Search Mass Estate Tax Rate Table.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Example - 5500000 Taxable Estate -. Settlement Tax Rate Table.

Up to 25 cash back If you were to translate the amount owed into a tax rate on the portion. Get Results On Find Info. Seven states have a flat.

City and Town Property Tax Levies by Class. Ad Access Tax Forms. 2022 Massachusetts Property Tax Rates.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Tax amount varies by county. The median property tax in.

The median property tax in Massachusetts is 351100 per year for a home worth. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Can Married Couple Shelter 2 Million From Massachusetts Estate Taxes

Ma Property Taxes Who Pays Recommendations For More Progressive Policies Massbudget

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

State Tax Levels In The United States Wikipedia

Estate Tax Changes Appearing More Likely In Massachusetts Boston News Weather Sports Whdh 7news

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Rates Forms For 2022 State By State Table

The Kiddie Tax Changes Again Putnam Investments

3 Federal Marginal Estate Tax Rates For 1996 Download Table

Massachusetts Who Pays 6th Edition Itep

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Moved South But Still Taxed Up North

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

How Do State And Local Property Taxes Work Tax Policy Center

State By State Estate And Inheritance Tax Rates Everplans

Estate Tax Rates Forms For 2022 State By State Table

Massachusetts Who Pays 6th Edition Itep

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It